Automating your practice with FYI, Xero and Practice Ignition

Last week, our CEO Rob Cameron, had the pleasure of joining a live panel together with Ethan Cooney from Practice Ignition, Rebecca Mihalic from BusinessDEPOT, and Breanna Martin from Xero. They discussed the benefits of automating your practice and showed how simple repetitive processes like income tax returns can be seamlessly automated using Xero, Practice Ignition and FYI.

You can watch the full 60-minute recording to hear why automating repetitive processes is key to your practice’s productivity.

Streamline your Practice App Stack from ignitionapp on Vimeo.

Or, for those short on time, here’s a snapshot of a few key take-outs:

1. Time and capacity to grow your business

In the challenging COVID-19 world we live in now, there is no better time to be cloud-based. Leveraging technology – in particular, automation – enables you the time-savings and flexibility to continue to offer clients a high standard of service, while helping you grow your firm.

To get more time into your day, you should be automating the more repetitive tasks. Try to get all of your tools to talk to each other. This will eliminate the need for double handling, and having to move items from one place to another.

Thankfully, technology never sleeps, so you can have rules and automation running for you in the background 24/7. This reduces your administration costs. Think of technology as a full-time employee! Every time you automate a manual process, it saves you that employment cost and allows you to use your team members to do other things to generate more revenue. And the best part, you can use tasks and alerts to keep up to date with what’s going on in your business to stay on top of things.

“Three years ago, we had two and a half staff members in the administration team. Thanks to our investment in tech and automation, we have now doubled our revenue and I have one administrator who works four days a week for six hours a day. We haven’t dropped our level of service, and our administrator is now completing a tax return course so that she can add more value to the business because she has the capacity to keep learning new things. So, we’re improving her job satisfaction thanks to some of the processes we’ve put in place.” Rebecca Milhalic – Business DEPOT

When you implement a really great tech stack and you’re using automation so your team is not double handling, you can use all of that extra time to focus on growth opportunities – like building better relationships with your clients – so you can understand more about their businesses and provide more services, etc. And with the extra revenue generated from the time you put into your relationships, you can invest in marketing to attract even more clients and improve all the processes around onboarding and engaging clients in a better way.

2. Build a stack to suit your needs

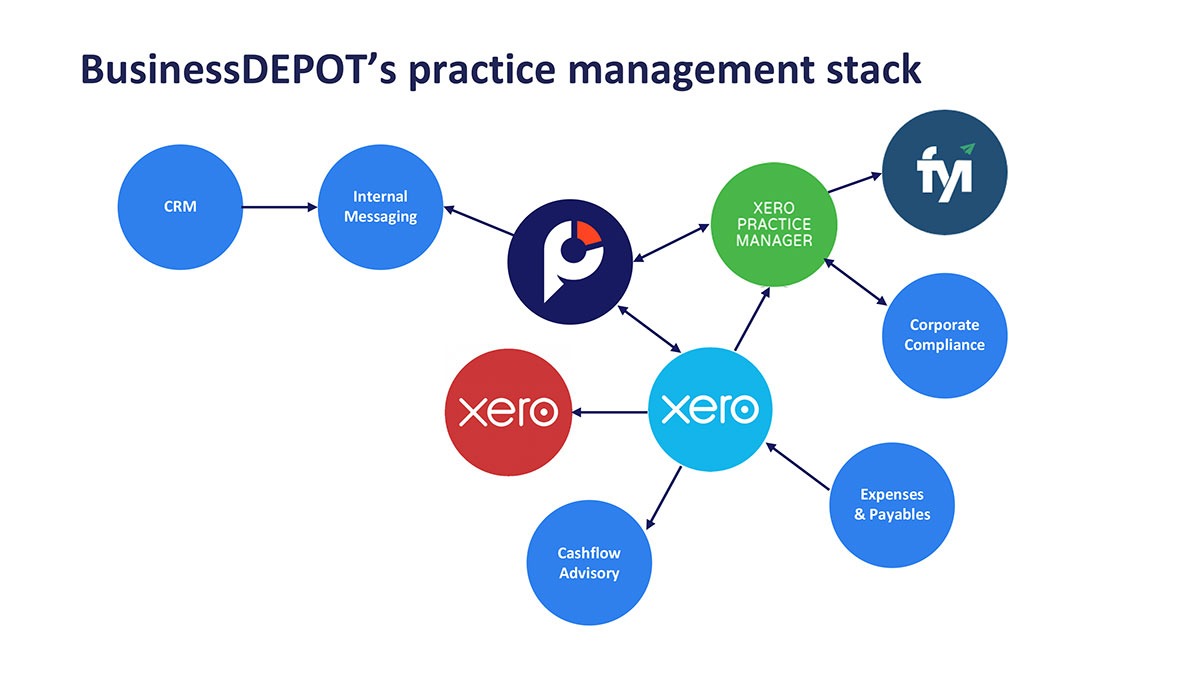

What’s really important is integration – everything talks to something else and Xero and Xero Practice Manager serve as the single source of truth. Your client database flows freely between Practice Ignition, FYI and XPM, and only needs to be maintained in one place, to make sure that it’s updated in all of the systems. Emails never go to the wrong email address, you’ll always have the right contact phone numbers for clients, and your team will always know who is in a client group.

Practice Ignition

Business Depot uses Practice Ignition to deal with any client conversations around fees or scope at the beginning of an engagement. They’re able to create a quick engagement for their clients and if there is no agreement on value, they don’t go any further. They manage scope really well and anytime a client calls, it takes less than a minute to pull up an engagement, check it to make sure it’s in scope, and how much they’re going to get paid for it. And if it’s not in scope, they can very quickly send a new engagement for the client to sign before they get on to it. So, they are always getting paid for the work they do and debtors are within terms because they take control of the payments, and get paid all the time.

Xero Practice Manager

For workflow and job management, Business Depot use Xero Practice Manager as their single source of truth. It is where their client details are always 100% up to date. It manages all of their jobs from start to finish, it’s where they do their timesheets and all of their WIP reporting. They use the e-sign features inside the tax returns to send everything out to have it electronically signed and lodged with the ATO, and then use the signing reminders so that their clients are getting reminded to action all the items.

FYI

More recently, Business Depot added FYI to their tech stack, using it for document management and client communication, and to bring together some of the other tools they’re using. As a DM solution, FYI eliminates the need to go to multiple places to find client information. Everything is in one place – emails, documents, spreadsheets, weblinks, all stored against a client and job. From inside FYI, you can see your client’s individual Xero Ledgers and link into XPM, and when tax returns are signed off inside XPM, they get filed in the client folder in FYI as well. So, there is a commonality between XPM and FYI. And if a new client is created in XPM, it also creates the new client in FYI. You can also share documents with clients in a safe environment from inside FYI, and use a number of trigger-based automations such as auto-doc sharing and auto-email creation, which fast-track some of the processes that most practices are doing manually.

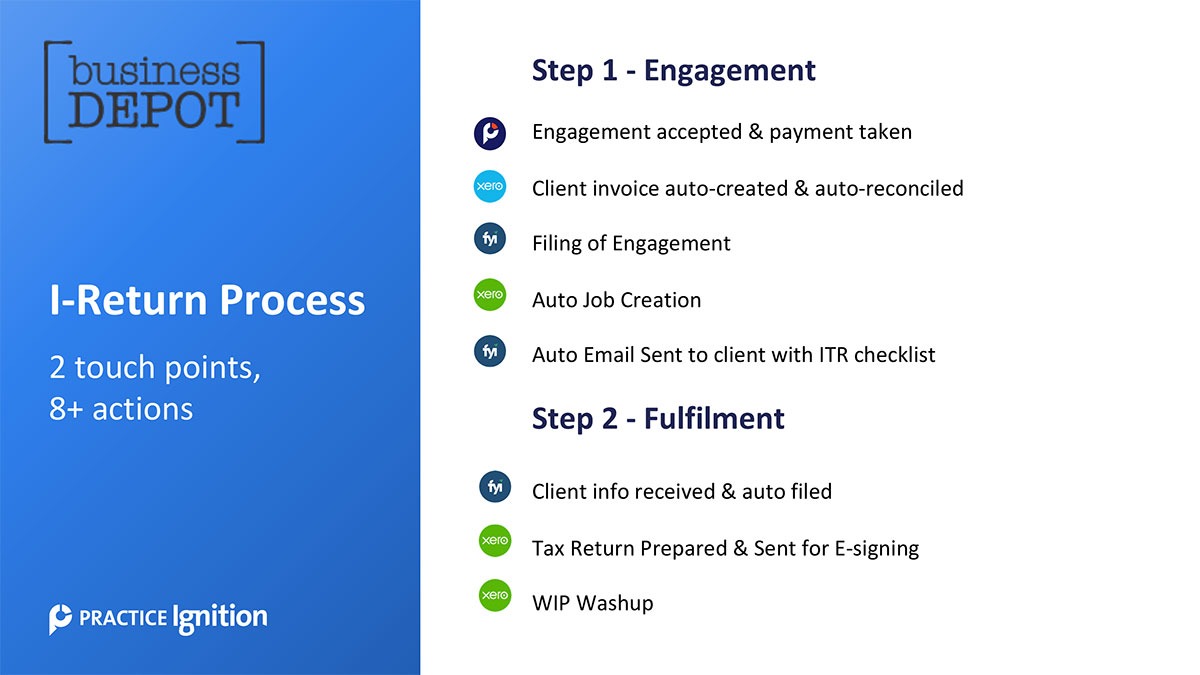

3. Automate simple, repetitive processes such as I-Returns

Lower value services such as individual tax returns are begrudged in most firms. The client often needs extra attention and the administration required can make the task seem not high-value enough to bother. However, having the correct tools and processes in place can make I-Returns a lot more of an attractive option.

BusinessDEPOT’s interactions with their clients start with Practice Ignition – sending out an engagement using a templated I-Return process. When the client accepts the engagement, they take their payment details. Since I-Returns are a small task and turn-around is usually quick, they actually bill clients up-front and take payment before they even start the job.

There are then four automations that occur immediately related to the engagement and information-gathering part of completing the tax return:

- A client invoice is auto-created and reconciled in the Xero Ledger, and payment taken via Practice Ignition will automatically be marked off on the invoice inside Xero and reconciled

- From Practice Ignition, the signed engagement will be automatically filed in FYI

- The job is automatically created in XPM with the right staff allocation and tasks, and synced into FYI, so you’ll be able to see the job in FYI and can file any document or information directly against that job

- When FYI sees that this job is created, it will automatically create an email and send it to the client with an individual tax return checklist that they need to complete.

So, all BusinessDEPOT has done is send out an engagement, and they’re already at a point where the client is sending the information they need to actually do the work! Throughout this whole process, there are really only two points where you have to manually interact with your client – sending out the engagement, then sending out the signed tax return. Everything else happens for you automatically.

Click here for a step-by-step outline of how BusinessDEPOT uses their tech stack to automate their I-Return process, from initial proposal to completed work.

Remember, the I-return example is just one service where you’ll see a return on investment from automation. The same principles could be applied to quarterly BAS statements, annual accounts, interim reviews, FBT returns….the possibilities are endless! Any process that requires you to send out an engagement and get information from your clients, can be automated.

Want to see FYI in action? Join an online demo, and let us give you a platform tour or show you how to get started. And if you’re ready to experience the transformation FYI will make for your practice, sign up for your 30-day free trial today.